Time to retire

Whether you’re starting to wind down by reducing your hours, or still working full time with an eye on the day you can stop, there are a few final steps you can take to prepare for retirement.

Your reading list:

Review your finances

If you have any debts, could you clear them before your retirement date? The MoneyHelper website has a ‘Bill Prioritiser’ tool, which can help you by sorting your bills and payments into the right order and explaining what you need to do if you are struggling to pay.

Once your debts are clear, you should concentrate on building up an emergency cash reserve – just in case if any of your pension payouts are delayed.

If you think you may have lost touch with a former pension plan, the government provides a free tracing service to help you find it again.

You may also have other lost savings accounts or investments, such as premium bonds or ISAs. You can track them using My Lost Account.

Check your retirement budget again and make sure your estimated income is going to cover all your outgoings, with some extra spare for emergencies.

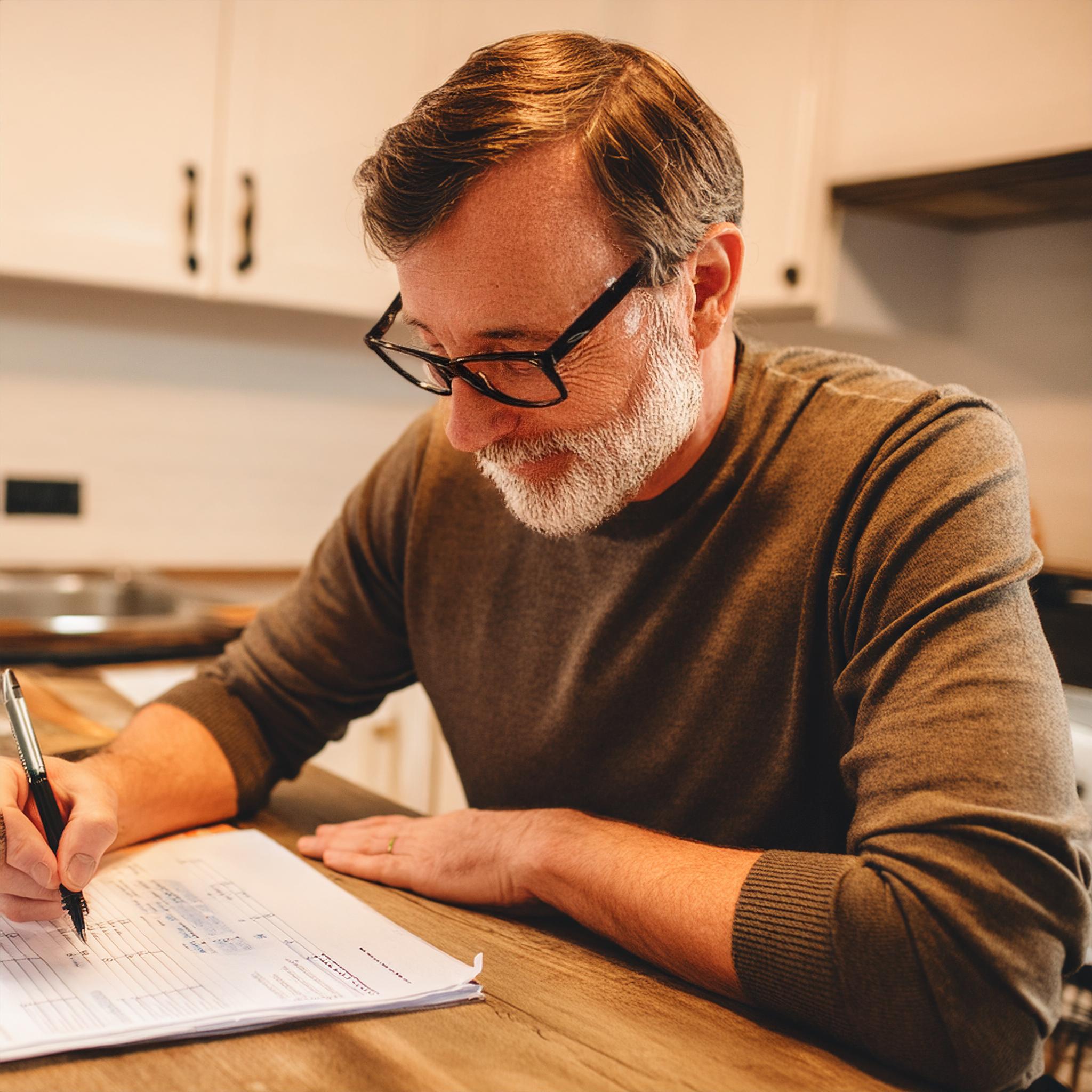

Get your paperwork in order

Give your pension providers plenty of notice of your chosen retirement start date (six months should be enough). In any event, you can expect to hear from Aptia, the Whitbread scheme administrator, around six months before your retirement date – as long as they have your correct contact details.